- Routing #311982435

- Schedule an Appointment

- Contact Us

- Routing #311982435

- Schedule an Appointment

- Contact Us

Financial Wellness

Take Control of Your Financial Health!

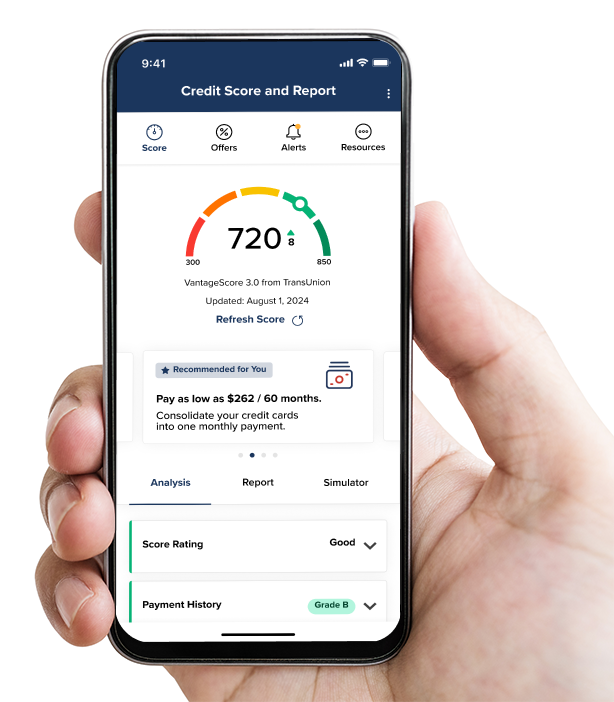

Staying on top of your finances has never been easier! We want to provide you with all the resources that you need to take control of your financial health. As credit score is an integral part of financial health, we are happy to offer you this tool for FREE to help you achieve your credit score goals. We are honored to be part of your financial journey!

- Daily Access to Your Credit Score & Report

- Real Time Credit Monitoring Alerts

- Financial Checkup

- Credit Score Simulator

- Credit Score Goals and Action Plan

- Financial Education Tips

- Special Credit Offers... and More!

Financial Wellness

- Do race, age, and other, non-credit related factors affect my VantageScore® credit score?

One of the most important misperceptions about credit scores is what information the

VantageScore® model, or any credit scoring model, is NOT used. The

VantageScore® model does not consider race, color, religion, nationality, sex, marital status,

age, salary, occupation, title, employer, employment history, where you live or shop. - What Factors Influence My Credit Score?

Five major categories make up a credit score:

40% Payment History

Essentially, lenders want to know whether you’re good about paying your loans on time.- 23% Credit Usage

Credit usage, or credit utilization, is the ratio between the total credit used and your total credit limit on your revolving accounts. It is best to keep your credit usage below 30%. - 21% Credit Age

The average of your oldest open credit accounts to your newest open credit accounts

determines your credit age. Generally, the longer your credit history, the better, particularly

for accounts with a good payment history and no late payments. - 11% Credit Mix

It’s essential to have a mix of different types of credit, like revolving credit and installment loans. Your score will likely be higher if you have a good payment history with installment loans, like student loans and mortgages, and revolving credit, like credit cards. - 5% Inquiries

Any time you apply for a credit card or a lender checks your credit for a loan, it’s known as an inquiry. Hard inquiries show on your credit report when your credit is pulled by a lender for a car loan, mortgage, or credit card. However, soft inquiries don’t show on your credit report and occur when you check your credit or a lender pre-approves you for an offer.

Applying for several credit cards or opening multiple credit accounts in a short period creates hard inquiries and could signal an increased credit risk to a lender.

- What Does a "Good" Credit Score Mean to Me?

A good score may mean you have easier access to more credit and lower interest rates. The

consumer benefits of a good credit score go beyond the obvious. For example, underwriting

processes that use credit scores allow consumers to obtain credit much more quickly than in the

past. - What is VantageScore®?

VantageScore® was founded by the three leading credit reporting agencies – Experian, Equifax,

and TransUnion. This credit score model was developed by a representative team of

statisticians, analysts, and credit data experts from each of the credit reporting companies and

is used by hundreds of institutions, including credit unions, banks, credit card issuers, and

mortgage lenders.

The VantageScore® 3.0, the score that is shown in SavvyMoney, is a newer and more popular

version of VantageScore®. It is calculated on a scale of 300-850, with 300 being the lowest and

850, the highest score. - What is a Credit Score?

A credit score is a three-digit number calculated to indicate your creditworthiness. The higher

the score, the more creditworthy you are to a lender. A credit score is calculated from the

information in your credit report. It considers your on-time payments, the length of your

payment history, your mix of different types of credit accounts, and other such factors. It is

essential to know that your score does not take your age, income, employment, marital status,

or bank account balances into account.

You can learn more about credit scores and scoring models from the Consumer Financial Protection Bureau website here.